Select Sidearea

Populate the sidearea with useful widgets. It’s simple to add images, categories, latest post, social media icon links, tag clouds, and more.

hello@youremail.com

+1234567890

+1234567890

Populate the sidearea with useful widgets. It’s simple to add images, categories, latest post, social media icon links, tag clouds, and more.

Iztok Franko

Do you want to know the latest airline industry trends?

Is generating more ancillary revenue still a top priority for airlines?

Why do airlines want to become like OTAs, and why are some airlines talking about becoming digital companies?

How good exactly are airlines at becoming real digital retailers?

If you want to know answers to the above questions, then look no further!

The 2019 Airline Digital Retailing Survey is Diggintravel’s 3rd annual survey and research project in the field of airline digital retailing and ancillary revenue. The goal of this research was not to present the detailed statistics and benchmarks of airline ancillary revenue. You can find detailed statistics in other reports, like the IdeaWorksCompany’s Yearbook of Ancillary Revenue.

Such benchmarks can help you understand (if you’re still not convinced) WHY growing ancillary revenue is crucial for your airline’s profitability. However, just knowing the latest benchmarks and airline industry trends is not enough!

This is why we wanted to analyze WHAT airlines are doing to develop their ancillary revenue and HOW they’re doing it. More specifically, our survey investigates the maturity of the digital retailing processes and key challenges airline professionals are facing when it comes to growing ancillary revenue.

During the first and second quarters of 2019, we sent our survey questionnaires to more than 120 senior ancillary revenue, digital and other airline executives.

The survey represents the views of 45 carriers, providing intriguing insights into the state of digital retailing for the airline industry.

The goal of the survey was to evaluate digital retailing maturity within airline organizations.

For evaluation of maturity, we structured questions around five main areas:

You can find the exact questions, survey results and detailed analyses for each area in the special section at the end of this report.

In addition to the survey questions, we performed a digital audit of booking platforms for all 45 participating airlines.

During the audit, we evaluated various merchandising elements, including presentation of branded fares / fare families, presence of dynamic bundles and personalized products, upsell mechanics, a la carte ancillary product offering, and usage of persuasion methods.

In the last part of the survey, we asked participants about the key challenge that limits them in taking their ancillary revenue efforts to the next level. By combining key pain points with the areas in which airlines plan to invest in 2019, we set out to uncover the main focus of 2019 airline ancillary revenue and the latest airline industry trends.

As a result, we updated our Airline Digital Retailing Framework (check out the framework here).

We scored the participating airlines’ maturity in each of the five main areas of the aforementioned Digital Retailing Framework. Individual responses to the survey questions, the results of our digital audit of the booking funnel, and any available ancillary revenue financial data (ancillary as a percentage of total revenue) all contributed to the final result.

The sole purpose of ranking the survey results was to see if we could group airlines into different categories based on their digital retailing maturity and then provide guidelines on how to advance.

Based on the results, we classified each participating airline into one of the following three categories:

Here you can see the summarized results of our Airline Digital Retailing Survey and benchmarks:

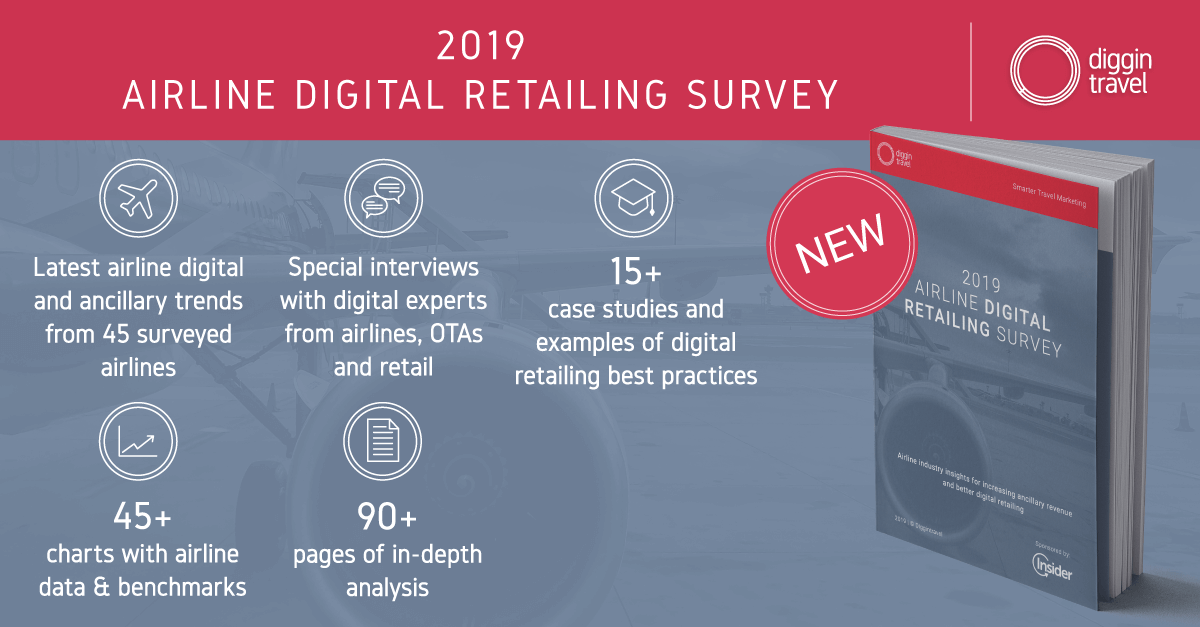

Click the link below and get the PDF version of our 2019 Airline Digital Retailing Whitepaper. In addition to the latest airline industry trends, this is what you’ll get with this download:

➡️ The latest airline digital and ancillary trends from 45 surveyed airlines

➡️ 90+ pages of in-depth analysis

➡️ 45+ charts with the airline benchmarks

➡️ Special insights & interviews with digital experts from airlines, OTAs and retail

➡️ More than 15 case studies and examples of digital retailing best practices

Get your 2019 Airline Digital Retailing White Paper now »

[NEW] Want To Take Your Airline Digital Retailing To Another Level >> CHECK OUR AIRLINE DIGITAL RETAILING ACADEMY

I am passionate about digital marketing and ecommerce, with more than 10 years of experience as a CMO and CIO in travel and multinational companies. I work as a strategic digital marketing and ecommerce consultant for global online travel brands. Constant learning is my main motivation, and this is why I launched Diggintravel.com, a content platform for travel digital marketers to obtain and share knowledge. If you want to learn or work with me check our Academy (learning with me) and Services (working with me) pages in the main menu of our website.

Download PDF with insights from 55 airline surveyed airlines.

Thanks! You will receive email with the PDF link shortly. If you are a Gmail user please check Promotions tab if email is not delivered to your Primary.

Seems like something went wrong. Please, try again or contact us.

Samvrant Ray

Hello Iztok,

Being a market research person I liked the post, but I wanted to know how and what are the technologies play a good role in the airline industry. what are the driving factors, and is there any new entrant in the market that will largely the small industries who are still unable to adopt the travel technologies.

Iztok Franko

Hi Samvrant – there is a special chapter about Innovation & Technology in the whitepaper. You can download the paper and check to find more (plus examples and case studies).